Just like the “cycles” of life, every business must go through “cycles” and face different challenges as it grows and matures. For established companies, business succession planning becomes an essential next step to ensure continued growth and long-term stability.

Every business owner that has achieved any level of success knows that building a viable company requires dedication, commitment, hard work, and even a little luck. For most, it takes years of sacrifice, discipline, and consistent focus, not to mention blood, sweat, and tears.

If you are reading this, you have climbed the mountain, or at least gotten a long way up the hill. The fruit of your labor is a stable organization with consistent revenues and sustainable growth. Now that you have achieved these coveted goals, it is time to establish a business succession plan that guarantees the ongoing success of your company regardless of future events.

How can you fail to plan for the effective transition of your business, the one thing you have dedicated so much time, energy, heart, and soul? This step by step guide will help you to ask the right questions and begin to develop your business succession planning strategy. Start NOW

Key Takeaways of Business Succession Planning

-

A clear plan ensures business continuity, minimizes disruptions, and helps maintain relationships with clients, employees, and vendors during a leadership change.

-

Despite the awareness of its importance, few business owners have a comprehensive succession plan in writing, putting long-term stability at risk.

-

These agreements clarify what happens to ownership shares if an owner retires, becomes disabled, or dies, and they offer tax advantages when structured properly.

-

Proper funding vehicles and an accurate business valuation are critical to cover buy-outs, support cash flow, and reduce tax exposure during transitions.

-

Emotional dynamics, unclear expectations, and choosing between family members and key employees make planning essential to preserve the family legacy and avoid internal conflict.

What is Business Succession Planning?

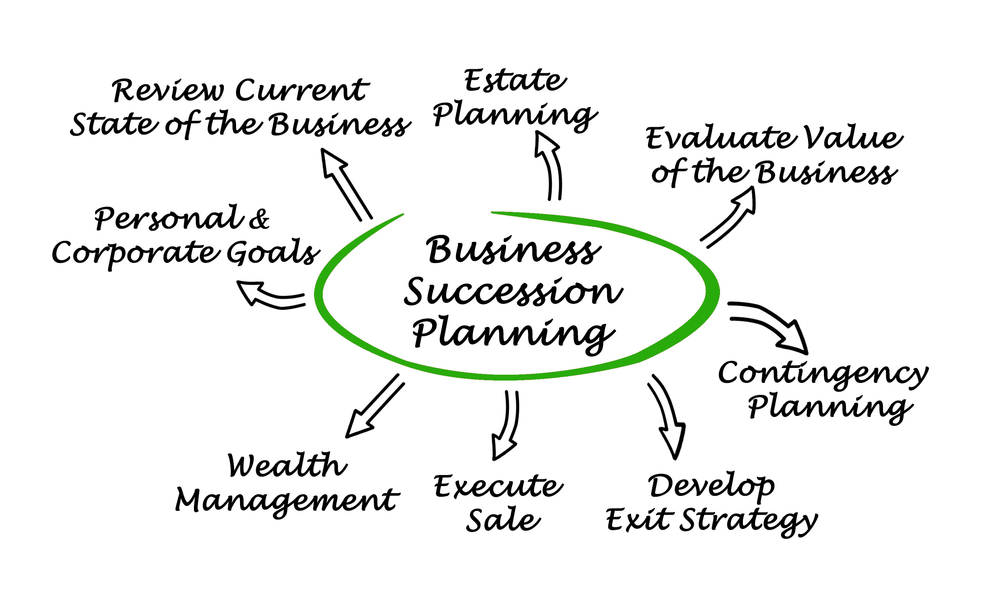

Business succession planning, sometimes referred to as business continuation planning, is the process of determining the primary goals and desires of the business owner(s) when it comes to the ultimate disposition of their business interest.

A properly structured plan addresses all potential contingencies that may compromise an organization’s ongoing viability, including but not limited to, the death, disability, or retirement of an owner or key executive or the eventual sale of an owner’s equity interest. In essence, the succession plan is the blueprint for the efficient transition of management and business ownership.

A succession plan usually includes a buy-sell agreement, which is a legally binding document that covers all of the “what ifs” that may threaten the ongoing operations of a company. A strong buy-sell agreement is comprehensive and considers all legal and tax-related issues. The primary purpose of the “agreement” is to outline and define, in advance, what is to happen in the event of the death, disability or retirement of an owner or the sale of an owner’s business interest.

Why is Business Planning Important?

The following are just a few of the many reasons why business succession planning is so important.

- The extent of business succession planning for most business owners is a simple will.

- The majority of small firms are likely to suffer financially if the owner were to die or have a long-term disability. Yet, only 20% have business life insurance, and 18% have business disability insurance. Source: LIMRA’s “Small World: Trends in the U.S. Small Business Market,” 2012

- Ninety-Five percent of small business owners acknowledge the importance of exit and succession planning; only one in eight has a written plan for leadership continuity. Family Business, Your Most Important Issue, Successfully Passing It On! Forbes 2012

- Even though nearly 70% of family businesses would like to pass their business on to the next generation, only 30% will be successful at transitioning to the next generation. Peak Family Business Survey, 2011.

- According to Hartford Life’s 2012 Report: “Small Business Success Study,” 78% of small businesses are family-owned.

- On average, 45% of the business owner’s net worth is in the business itself. LIMRA International, Small Business Owners 2009 Report

- By 2017, estimates predict 40% of family business owners expect to retire, creating a significant transition of ownership in the US. Less than half of those planning to retire in five years have selected a successor. Mass Mutual American Family Business Survey, 2007.

- A recent global survey by RBC Wealth Management and Scorpio Partnership found “the majority of business owners are relatively unprepared to pass on their financial legacy.”

- A 2017 Principal Financial Group Survey of 1,000 Business Owners, conducted by Harris Interactive, found that business protection and income protection were the #1 and #2 areas of concern. Still, only 36% of owners surveyed had adequate life insurance, and only 33% had sufficient disability coverage. Furthermore, succession planning was #7 on the list, with only 51% having done any preparation.

- In PwC’s 2017 US Family Business Survey, nearly 44% of those we surveyed say that succession planning will be a challenge over the next five years, and only 23% say they have a robust, documented succession plan in place.

trusted by 5,000+ clients

Compare Business owners Rates

See rates and benefits tailored to your business needs.

Five Major Objectives of Business Succession Planning

At the outset, planning for the effective transition of any business generally involves five primary goals:

1. Ensure that the company continues to run efficiently and effectively

The last thing any outgoing business owner wants to see is the gradual decline and ultimate failure of what they worked so hard to create.

In some cases, retiring owners and their dependents may rely upon the continued success of the company for ongoing income. Therefore, keeping the business profitable is critical. Effective planning can provide the necessary strategies along with the resources required to ensure the business will continue to prosper.

Just a few of the many concerns:

- If a “key person” dies, how is the business going to find a capable replacement in a timely fashion?

- How is the company going to pay for the cost of hiring and training?

- If an owner dies, how is the business going to handle the equity buy-out?

A business without a plan is rendered helpless to disruptions both internally and externally that threaten the very existence of the organization.

2. Maximize the value of the company.

The ultimate goal of any entrepreneur or business owner is to continuously increase the profitability of the business and thereby create maximum value. And, when the company sells, the owners can reap the reward of their efforts. Business succession planning will address all threats that can undermine the value of the business.

For example, let’s consider a family-owned business without a plan. If one of the family members, who is also an owner, gets permanently disabled, what are the effects on the company?

- Can the company afford to pay a continued income to the disabled owner when they are not contributing to the profitability of the organization?

- Where are the funds coming from to hire a replacement, and how quick can a replacement be located and at what cost?

- How is the company going to deal with the disabled owner’s equity interest?

- Will the company have to be sold? Who will buy the business?

In this case, a disability can result in a significant blow to revenues and profits. Also, the fair market value of the business can take a considerable hit.

3. Minimize taxation of key man insurance.

Taxes, Taxes, Taxes!!! No one wants to pay them!

This is especially true for business owners who have, in most cases, given the better part of their lives to the development and growth of their company.

There are many concerns with minimizing taxes on the transfer of a business interest, but the biggest is federal estate taxes. Lack of business succession planning and an effective estate plan can result in significant cash flow issues and could very easily result in the forced liquidation of the business at less than fair market value.

Federal estate tax rates and exclusions are becoming significantly more favorable in recent years. However, there are still numerous estate planning techniques available to reduce tax exposure substantially.

4. The efficient transition of ownership and control of the business.

The smooth transition of ownership is critical to the continued success of the company. When an owner retires, considerable uncertainty can permeate an organization. Therefore, preparation and proper execution of a succession plan can have a significant impact on the future success of the business.

- For example, a business can be dramatically affected if one of the owners decides to retire.

- How is the business going to replace the owner’s contribution to the company?

- How long will it take to find a replacement, and at what cost? Often more than one person may be required to cover the responsibility of the departing owner?

- Will funds be available to buy-out the retiring owner’s estate? What is their equity interest? What is the value of the business?

In this case, a straightforward buy-sell agreement would address each of these concerns and have the directives in place to execute the predetermined strategy.

5. Who will ultimately manage the organization?

A business that loses an owner due to a death, disability, or retirement must be able to continue day to day operations efficiently and effectively to survive and prosper.

Most successful business owners have extensive experience and developed specialized talents that are crucial to the business. These individuals have also developed trustworthy relationships with employees, vendors, and, most of all, clients. Somehow, these relationships must be cultivated and sustained.

Effective business succession planning outlines management strategy, including identifying those within the organization that is capable of managing the business as well as potential external sources of management/ownership.

Finally, a good plan should provide adequate resources to continue operations in any adverse situation and create flexibility and options for the future.

Essential Questions for Business Succession Planning

Before drawing up any formal agreement or purchasing any financial product, the first step in business succession planning is to gather all of the information needed to assess the situation from a financial perspective as well as a “people” perspective. Uncovering unified goals require some serious “soul searching” on the part of the business owner(s) and will take some sound decision making.

Before any formal planning can begin, every business owner must address many questions. Some of the more prominent include:

- Is there an existing plan in place? When was the last time it was reviewed and updated?

- What are your personal goals? How long do you want to work?

- What are your future goals for the company?

- How are you going to replace income when you retire? How will you maintain your lifestyle?

- What is the business worth? While most business owners have an idea of the value of their company, it is essential to understand the concept of “fair market value” and to utilize the appropriate method for determining the value of the business.

- How are you going to get maximum value for the business?

- What is your desire for the business if you died or become disabled? Who would manage the company in the short-term? Who would eventually own the business?

- Is the company saleable? Can an outside buyer for the company be easily located? Is there a key employee candidate to buy the business?

- Is the company going to pass to your family members, or will the company be sold to a third party? Will you stay on in an advisory role or make a clean break?

- What type of training or specialized knowledge do you need to pass on to your successor? Training may include introductions to vendors and clients.

- What are the most important things that you need to do to prepare a successor for the best results?

- If you are a one-owner company, does your spouse know anything about the business? Have you communicated to your spouse or critical employee what would happen if you became disabled or died?

- What type of exit strategy are you going to implement?

- What are the potential tax implications of any of the above?

Unique Concerns for Family-Owned Businesses Succession Planning

The historical success rate for the transition of family-owned businesses has been quite low.

According to the Family Business Alliance, June 2014,

“Only 30% of all family-owned businesses survive into the second generation. Twelve percent will still be viable into the third generation,with 3% of all family businesses operating at the fourth-generation

level and beyond.”

Probably the biggest reason is that family-owned businesses can present unique “people” problems that invoke emotions. Identifying these concerns is crucial if the transition of the company is going to be effective.

In most cases, there is significant uncertainty for the business owner surrounding the future of the company. When the family is involved, and specifically children, they may be anxious about their ability to “get the job done.” Are they willing to make sacrifices to prosper the business? Are they capable of making the tough decisions? Is the successor’s vision for the future of the company harmonious with the owner’s vision?

A first step any departing business owner should take is to carefully evaluate the critical people in the company that can be decision-makers. Any owner of a profitable business knows that their key employees are responsible for a large part of the company’s success. Identifying potential successors for the most crucial roles in the company is not only a smart ongoing business strategy but will be essential to a smooth business transition.

In many cases, your top people may not be family members, and this will very likely present a conflict. When family business succession planning under these circumstances, the business owner must communicate the plan to both family members and key employees. Otherwise, clashes will inevitably arise.

Key employees must feel respected and valued for their past contributions to the business and their ability to be a factor moving forward. The last thing any organization going through a transition needs is disgruntled key employees who are willing to pick up and move to a competitor because they feel underappreciated.

Transitioning a family business to the next generation should not be a “rite of passage” for the successor(s). Here, the emotional aspect of family business succession planning can become significant. While these are tough decisions, the goal is long term sustainability of the company. The right person to lead the business is the one that will give it the best chance to prosper. Objectivity is fundamental.

To maintain the efficiency and effectiveness of the ongoing business, fitting the pieces of the puzzle together in terms of a “people strategy” will be paramount. Honest and effective communication with discernment is the key to making accurate evaluations and ultimately identifying the most qualified people to lead the company.

Succession Questions for Family-Owned Businesses

In addition to the questions previously listed, family businesses have to address the following:

- Are there any particular family circumstances with the transition of the company? Do the family members know the intentions of the business owner and the terms of the succession plan?

- Who will manage the business at the death, disability, or retirement of the business owner? How is business ownership going to be structured moving forward?

- How to effectively deal with the “people strategy” so the company and continue to perform successfully?

- What is the most efficient way to transition the business to a family member(s)? Does the business owner want to gift the company to the next generation?

- Is it better to sell the business to the employees or a third party?

- How to equitably account for a child’s inheritance that is not involved in the company?

With family-owned businesses, establishing a clear succession plan and communicating it to all interested parties is paramount to the ultimate success of the company. Without a clear plan, emotions can inevitably undermine the prospects of the business moving forward, and the ensuing chaos could result in the business becoming a mere statistic.

Components of Business Continuity and Succession Planning

Sound business succession planning includes:

Clearly defined goals of the shareholders or business owners are the keys to getting an optimal succession plan implemented. The more detailed and precise, the better. Use this fact-finding guide sheet to draw out ideas and contingencies for which you may not have thought to address.

At this point, it will be mandatory to enlist the help of professional advisors * in three areas:

1. A licensed attorney specializing in business law is compulsory and should guide you through the fact-finding process, assuring that you document your objectives accordingly

A Certified Public Accountant or Tax Attorney will also be indispensable when evaluating the tax consequences and potential strategies that may be most favorable.

A life and disability insurance broker that represents many top insurance companies will be essential to identify and implement the best financial products required to meet the objectives of the business succession plan.

2. You should enlist the services of a certified business appraiser. Many CPA’s are well versed in valuing businesses and the conventional methods used to assess a company.

3. Identify the appropriate measures to minimize business risk and protect the company’s reputation and position.

Examples may include:

Purchasing key man insurance that protects the business in the case of the death or disability of a key employee. Key man life and disability insurance can provide funds to the organization at a crucial time and allow the company to recruit and train a capable replacement without a financial cash flow hardship.

Provide executive benefits packages to the most valuable employees as a retention strategy and to tie them to your company. Executive Bonus and deferred compensation plans are two such options.

4. A realistic assessment of the “market” for the business in the event of a sale.

“Fair Market Value” is defined as the price a disinterested third party would be willing to pay for any asset.

Most business owners significantly overvalue their business. Therefore, reviewing market conditions will provide an accurate assessment of the company. A competent CPA can provide valuable insight into market conditions for specific industries and business types.

5. Establish a formal written agreement commonly referred to as a buy-sell agreement that will set in place the directives for the plan.

Once Items 1 thru 4 are clearly defined, it is time for your business attorney to put your goals and desires into legal written form. There are several different types of buy-sell agreements, and your legal and tax advisors can guide you in the right direction, given your circumstances. The key for you is to learn enough about your options so that you can make informed decisions.

6. Funding vehicles such as life insurance and disability insurance policies used to provide the liquidity needed if death or disability occurs or if an owner retires.

Life and disability insurance are ideal products to use when funding buy-sell agreements and or buy-out agreements because they provide liquid funds immediately at the triggering event of the death or disability of an owner.

Cash-value life insurance can also be used to fund buy-out agreements and may provide the added benefit of tax-free cash accumulation.

7. A formal process for periodically reviewing and updating the plan. A critical part of the ongoing business succession planning process.

The only constant is change. That is true in life and especially in the world of business. Therefore, any business succession plan must be reviewed and revised according to both the changing objectives of the business owner(s) as well as evolving market conditions.

A chief reason to review a plan is to make sure that the valuation of the company is accurate. The language in the agreement is usually binding, so getting the proper assessment of the shares of the business is vital.

A healthy succession plan is not a “set it and forget it” arrangement. A formal review of a business succession plan should occur every two years at a minimum but preferably every year.

The personal estate plans for each business owner should be a primary factor when creating a business continuation strategy. A competent estate planning attorney is crucial.

Benefits of Succession Planning

We have all heard the phrase, “failing to plan means planning to fail.” Clarity of purpose is imperative when it comes to business succession planning. Left to chance, the threats to business failure loom large. The death or disability of an owner or key executive can ruin a healthy business. The uncertainty that surrounds an unplanned business transition will create chaos among employees, vendors, and clients and may ultimately wreck everything you have worked your entire life to build.

While there are tough decisions to be made and careful considerations required on many fronts, business succession planning is not “rocket science.” The vision and goals of the business owner(s) should drive the business succession planning process. Working with competent advisors is monumental in helping make sure that all of the “bases are covered,” and the plan meets the legal test. Transparent communication of the overall strategy to key persons and family members will help avoid potential snares. Finally, reviewing and updating the plan will ensure the details are current and relevant.

Other Business Continuation Topics of Interest:

- Why Consider Succession Planning?

- What is a Buy-Sell Agreement?

- Using Life Insurance to Fund a Buy-Out

* We do not give tax or legal advice but certainly recommend working with a competent CPA and Business/Estate Planning Attorney when developing your succession and estate plans.

Frequently Asked Questions About Business Succession Planning: A Step by Step Guide

When should I start succession planning for my business?

Ideally, planning should begin as soon as the business reaches a stable growth phase. It’s never too early to prepare for future leadership and ownership changes.

What’s the difference between succession planning and an exit strategy?

Succession planning focuses on preparing the company and key roles for a smooth leadership transition, while an exit strategy outlines how the owner will step away, through sale, retirement, or otherwise.

Do I need a buy-sell agreement even if I don’t have a partner?

Yes. Sole proprietors can still benefit from having a documented plan outlining what happens to the business upon their death, disability, or retirement, including who takes over and how assets are handled.

What role does life insurance play in succession planning?

Life insurance can fund buy-outs, provide liquidity, or support surviving family members. It’s often used to ensure the business can weather the loss of a partner or key executive without financial strain.

Conclusion and Summary of Business Succession Planning: A Step by Step Guide

For many business owners, the company is more than just a livelihood, it’s a legacy. Establishing a business succession plan is not just about legal documents or financial strategies; it’s about protecting what you’ve built and ensuring your vision continues, even after your exit. Through careful planning, structured agreements, and the right professional guidance, business owners can transfer leadership and ownership with clarity and confidence.

Whether it’s preparing future leaders, maintaining family legacy, or protecting the value of your ownership interest, succession planning is a vital part of long-term success. Don’t leave your business future to chance, make it your top priority today.