For startups, transforming a vision into a thriving business often hinges on securing the right funding. While many avenues are available, SBA loans have emerged as a beacon of hope for many budding entrepreneurs.

These loans, however, come with their own set of prerequisites, prominently featuring insurance requirements. As founders embark on this journey, understanding the interplay between SBA loans and insurance, especially key person life insurance, becomes vital for success.

If you’re a start-up founder looking to understand the ins and outs of SBA loans and insurance, here’s what you need to know about the two’s relationship amd how they can give you long-term business resilience.

The Significance of Insurance in SBA Loans

Startups, with their inherent risks and unpredictable challenges, often find the financial landscape daunting. When applying for SBA loans, insurance requirements become a focal point for lenders – not just for compliance but to ensure the start-up has the mettle to make it long-term.

Lenders prioritize insurance as a means of risk mitigation. For them, it’s a reassurance that even in the face of unforeseen adversities, loan obligations will be met.

For startup founders, meeting these insurance requirements demonstrates strategic planning. It signals to lenders that the enterprise is safeguarded against unexpected disruptions, be it the sudden exit of a vital team member or other unforeseen circumstances.

More than just a mandate, insurance provisions act as a safety net, ensuring that the startup’s operations remain uninterrupted, stakeholders are at ease, and financial commitments are upheld.

In short, if a start-up can cover all of its bases with robust insurance coverage, the more likely an SBA loan application will be successful.

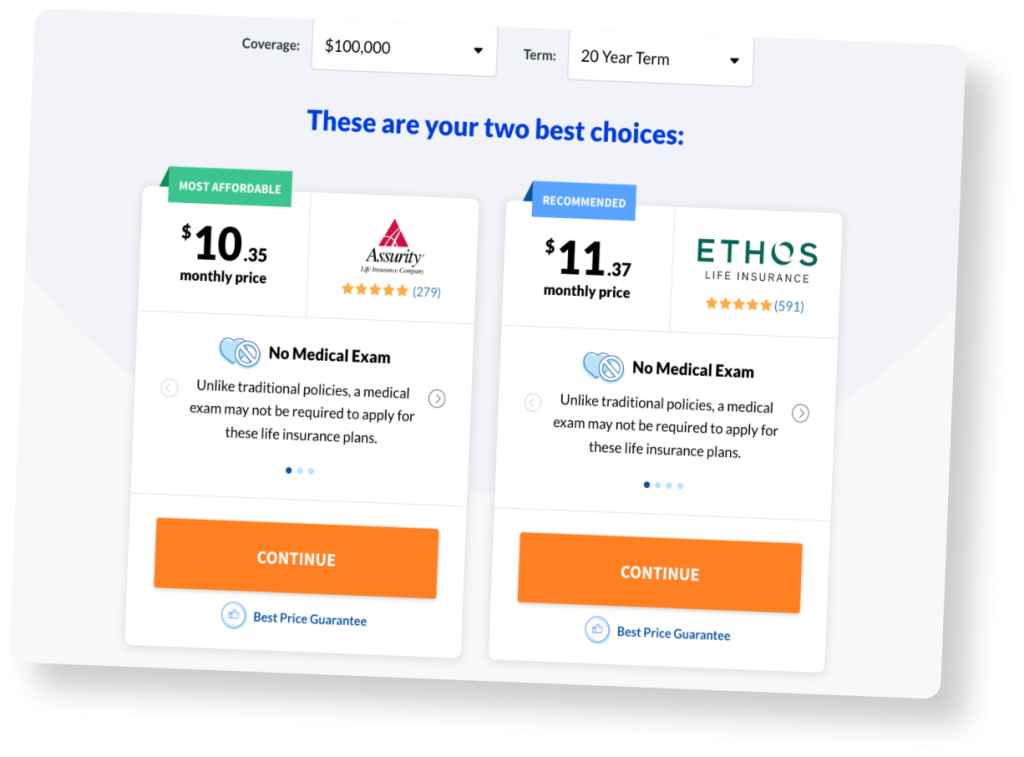

trusted by 5,000+ clients

Compare Start-ups Rates

See rates and benefits tailored to your business needs.

Demystifying Key Person Life Insurance

Every business has a linchpin person keeping everything together, which becomes even more true in a start-up environment. Key person life insurance protects startups from any financial repercussions if such a crucial figure were unexpectedly unavailable, like through death or illness.

At its core, this insurance provides a financial cushion. Key person life insurance compensates the startup for potential lost revenues, the costs of finding or training a replacement, or even facilitating a graceful business transition if needed. For many investors and lenders, it’s more than just a policy – it’s a testament to a startup’s proactive risk management.

Imagine a tech startup losing its chief developer or a health startup parting with its lead researcher. The void left behind isn’t just emotional; it’s financial and operational.

By investing in key person life insurance, startups send a clear message: they’re not only betting on their current success but are also prepared for future uncertainties, ensuring the dream remains alive and well, regardless of life’s unpredictabilities.

How Key Person Life Insurance Complements SBA Loans

Stability is a sought-after commodity in the world of startups, with SBA loans and key person life insurance working together to provide just that.

An SBA loan offers startups the essential capital to propel growth, purchase equipment, or expand operations. But lenders often want assurance that their investment is secure, even amid the volatility that characterizes the early stages of businesses.

Enter key person life insurance. For startups, this policy isn’t merely about risk mitigation; it’s a strategic tool that bolsters their SBA loan application. With a policy in place, startups showcase their commitment to long-term viability, ensuring that even if a pivotal team member is no longer present, the business can weather the financial storm. Crucially for the lender, the business loan obligations will be honored.

Pairing an SBA loan with key person/man life insurance assures lenders that the fledgling company isn’t just chasing a dream but is grounded in practicality, preparing for opportunities and challenges. It’s a surefire way to add credibility in the eyes of lenders.

Securing SBA Loans and Meeting Insurance Mandates for Startups

Navigating the path to securing an SBA loan as a startup involves a blend of preparation, persistence, and strategic foresight. Here are some steps to present an ironclad case to any lender.

Identifying Key Players

An essential first step is to outline the key individuals whose sudden departure would significantly impact the startup’s operations. Highlighting this to lenders showcases a depth of understanding of the startup’s core strengths and vulnerabilities.

Procuring Key Person Life Insurance

Once these pivotal figures are identified, procuring a key person life insurance policy becomes paramount. Such a policy not only satisfies the SBA loan prerequisites but also emphasizes the startup’s commitment to long-term sustainability.

If you need help determining what level of cover suits your start-up best, our specialist team can help you navigate the path ahead – just get in touch today.

Streamlining Documentation

Startups should ensure they maintain an organized dossier of all pertinent documents, from business plans and projections to insurance policies. This organized approach not only expedites the loan approval process but also underscores a startup’s professionalism and has you looking like ‘the real deal’ in a lender’s eyes.

In essence, bringing together the sought-after financial support with insurance requirements not only paves the way for crucial funding but also fortifies the foundation for future growth.

The Broader Benefits of Key Person Life Insurance

For startups, key person life insurance goes beyond merely satisfying loan criteria. This safeguard is great for instilling investor confidence, signifying a proactive approach to business risks.

Beyond financial protection, it also offers peace of mind to the entire team, reinforcing the startup’s commitment to stability and long-term vision.

In the fast-paced startup ecosystem, where adaptability is vital, key person life insurance emerges as a cornerstone cementing resilience and operational continuity. Any start-up founder shouldn’t be without it.

Wrapping Up

Through the strategic integration of SBA loans and key person life insurance, startups gain a competitive edge. These tools provide the essential capital and safety nets required for growth, ensuring startups can weather uncertainties and seize opportunities.

It’s about more than just SBA loan insurance requirements; it’s about instilling confidence among stakeholders, planning for continuity, and securing a vision for the future.