Minority-owned businesses are vital threads in the rich tapestry of America’s economic fabric, contributing significantly to innovation, job creation, and community revitalization.

However, these enterprises often face unique challenges, with access to capital being a predominant hurdle. In these situations, Small Business Administration (SBA) loans are a beacon of hope.

This article highlights how SBA loans unlock transformative opportunities for minority entrepreneurs, leveling the playing field and fostering an inclusive economic landscape.

What are SBA Loans?

SBA loans are loans supported by the U.S. Small Business Administration. While regular banks and credit unions give them out, the SBA promises to cover a part if the borrower can’t pay back, making it easier for businesses to get approved.

This hybrid model lets businesses secure loans under more favorable terms than they might achieve independently. The idea of an SBA loan is to help encourage entrepreneurial spirit and help businesses facing challenges, like start-ups or minority-owned companies, access funds when needed.

SBA loans are diverse, catering to a spectrum of business needs. From acquiring real estate or heavy machinery to bolstering working capital, these loans have been the financial bedrock for countless businesses, helping them navigate economic uncertainties and achieve their aspirations.

SBA Loan Programs Beneficial for Minority-Owned Businesses

The SBA offers different types of loans tailored to suit diverse business needs. Here are some of the ones which could benefit minority entrepreneurs:

- 7a Loan Program: The SBA’s flagship program is designed to help with a broad range of business needs, from working capital to buying equipment. These loans typically have flexible terms and lower down payment requirements.

- 504 Loan Program: Ideal for companies looking to buy fixed assets like real estate or heavy machinery, this loan type promotes economic development within communities, often helping minority businesses establish a strong local presence.

- Microloan Program: Catering to smaller financial needs, this program is perfect for startups or those requiring less significant capital. Organizations can also gain access to essential training and technical assistance.

Each program underscores the SBA’s commitment to fostering an inclusive entrepreneurial ecosystem, ensuring minority businesses have the opportunity to thrive.

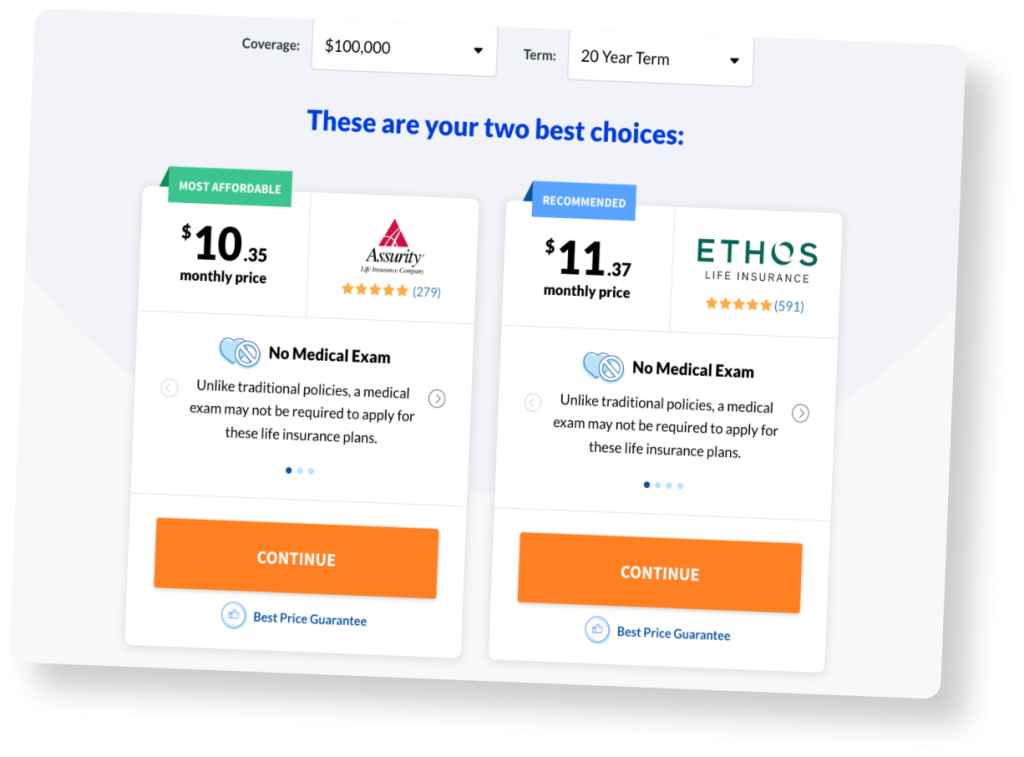

trusted by 5,000+ clients

Compare SBA Rates

See rates and benefits tailored to your business needs.

Advantages of SBA Loans for Minority Entrepreneurs

SBA loans serve as vital growth catalysts, specifically tailored to empower minority entrepreneurs.

They often come with competitive terms featuring interest rates that are typically lower than standard business loans. This affordability, coupled with longer repayment periods, creates a financial breathing room that’s indispensable for emerging businesses.

One of the standout features for minority entrepreneurs, who may grapple with limited initial capital, is the SBA’s lenient down payment requirements. This accessibility to essential funds is complemented by the SBA’s commitment to provide valuable business guidance. Minority business owners can benefit from a wealth of knowledge, from crafting business plans to mastering marketing strategies.

At its core, an SBA loan is more than just a financial transaction; it’s an opportunity. For those aiming to bolster their business credit profile, timely repayment can pave the way for enhanced future borrowing prospects.

Given the multifaceted needs of businesses, the flexibility of SBA loans — whether for staff hiring, inventory procurement, or premise expansion — ensures that minority-owned businesses are equipped to succeed in a competitive marketplace.

The Process of Acquiring an SBA Loan

Securing an SBA loan might feel daunting, but the process is simple. it’s pivotal to prepare a compelling business plan showcasing your business’s viability and potential for growth. With a plan in hand, approach an SBA-approved lender, which could be a local bank or a dedicated SBA lending institution.

The lender will guide you through their specific application process, requiring various documents like financial statements, personal background checks, and business credit reports.

After submission, patience is key, as the approval process can be meticulous. It’s not uncommon for lenders to request additional information or clarification.

Upon approval, ensure you understand all terms before finalizing. Remember, while the process might seem daunting, the potential growth and security an SBA loan offers make every step worthwhile.

If you need some help with your SBA loans application, we’re on hand to advise you every step of the way. Just get in touch to get the ball rolling.

Potential Challenges and How to Overcome Them

Getting an SBA can have some challenges ahead. One of the most frequent obstacles to getting approved for an SBA loan is having the right documentation, which can be a substantial amount of paperwork. To overcome this, it’s crucial to be methodical, keep organized records and seek expert advice when needed.

Another common issue is meeting the SBA’s eligibility requirements. While it’s a scheme designed to support small businesses, that doesn’t mean every entrepreneur qualifies. To improve your chances, read over the SBA’s definition of a small business carefully. You could consider tapping into local SBA resources or workshops for guidance.

If you do get rejected, it can be disheartening. However, they often come with feedback. Instead of viewing them as setbacks, use them as stepping stones. Understand the reasons, refine your proposal, and reapply.

The waiting period post-application can be tense. Rather than succumbing to anxiety, use this time productively. Continue refining your business strategies and exploring alternate funding avenues, ensuring your business isn’t solely reliant on the loan’s approval.

Challenges are part and parcel of the SBA loan process, but with the right preparation and help, they’re easily navigated. Your small business will soon be on the path to getting approved for an SBA loan.

trusted by 5,000+ clients

Get Personalized Quotes Tailored to Your Company’s Needs

Conclusion

The SBA loan pathway, while marked with challenges, presents a transformative opportunity for minority entrepreneurs. By understanding the intricacies of this financing avenue and addressing potential hurdles head-on, businesses can unlock the capital needed to fuel their ambitions.

With the right resources, determination, and guidance, minority-owned enterprises can leverage SBA loans to create lasting economic impacts, personally and for their communities.

If you’re in need of SBA loans or personal insurance advice to suit your business needs, get in touch to see how one of our experts can advise you.